Every year, organizations pour trillions into strategic initiatives—the bold projects meant to drive growth, spark innovation, and fuel transformation. Yet according to the Project Management Institute, for every $1 billion invested, $122 million simply vanishes due to poor execution.

This isn’t about isolated mistakes or occasional overruns. It’s a systemic drain on every strategic move you make—a hidden tax that doesn’t appear on any balance sheet but quietly undermines your most critical work.

What if you could see this tax clearly—and eliminate it?

Understanding the Strategy Tax

The Strategy Tax is the hidden cost of managing complexity with inadequate tools. It’s what you pay when spreadsheets, disconnected systems, and manual processes can’t keep pace with the scale and speed your strategy demands.

While it never appears on a balance sheet, this tax compounds with every project you add, every dependency you create, and every market shift you need to navigate, silently eroding the value your strategic initiatives were meant to create.

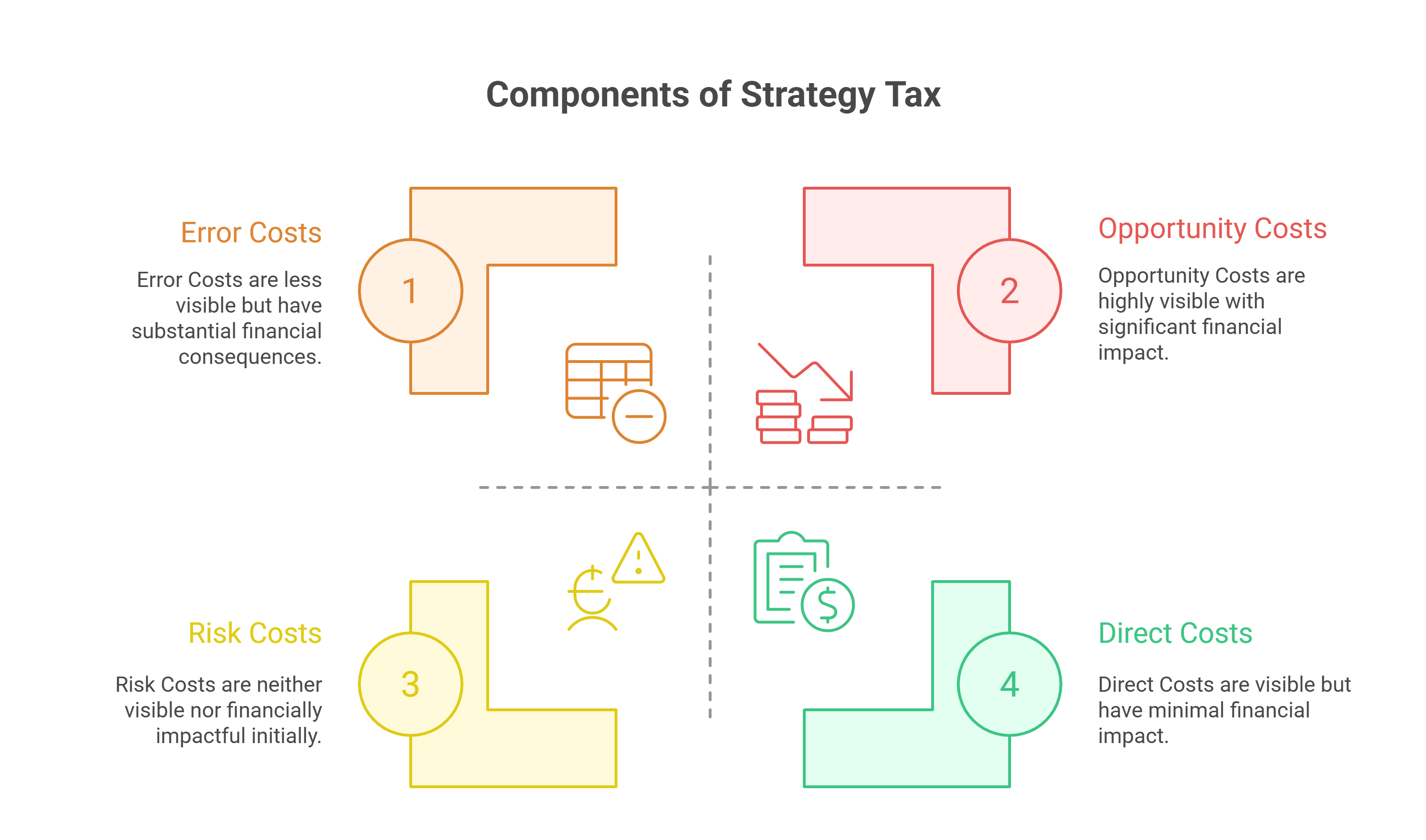

This tax has four components:

- Direct Costs — The visible drain: endless hours spent on manual data entry, reconciling conflicting spreadsheet versions, and building reports from data you can’t fully trust.

- Error Costs — The price of flawed decisions: with research showing 88% of spreadsheets contain errors, the question isn’t if bad data will cost you, but when and how much.

- Opportunity Costs — The value of delay: for a product worth $100 million in annual revenue, every day of postponement costs $270,000 in foregone opportunity.

- Risk Costs — The impact of blindness: when financial models disconnect from project plans, critical risks remain invisible until they derail your strategy.

Why Complexity Makes the Tax Unbearable

This tax has always existed, but two forces have transformed it from manageable friction into a major liability: accelerating change and rising complexity.

Business disruption has surged 183% since 2019, with technology as the primary driver, according to Accenture. In this environment, adaptability is everything. Yet the tools most companies depend on remain fundamentally rigid and brittle—unable to flex when circumstances demand it.

Visualizing Your Burden: The Strategy Tax Curve

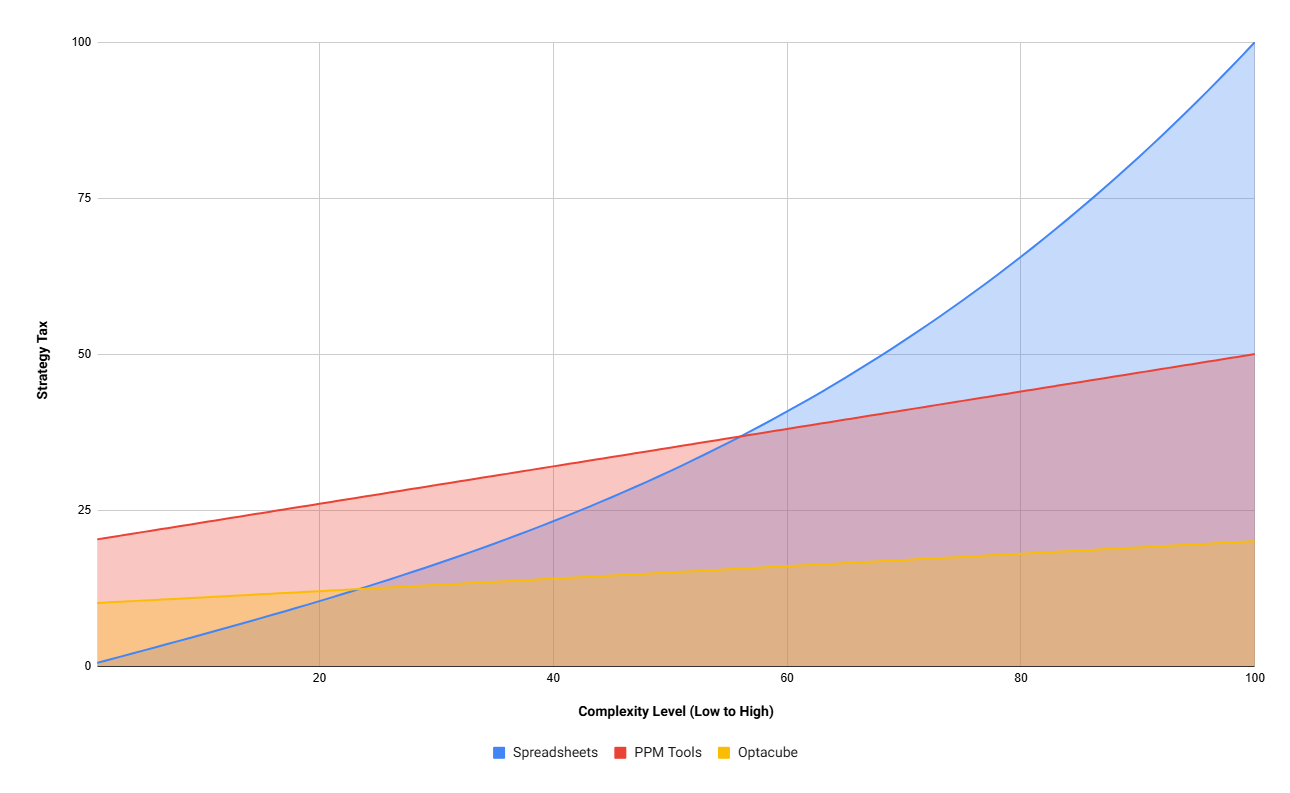

The Strategy Tax varies dramatically based on your organization’s complexity and the tools you use. Think of it as a curve that rises as complexity increases.

-

The Spreadsheet Trap — Spreadsheets seem cheap at first, but costs explode exponentially. As your portfolio scales and market uncertainty grows, manual effort and error risk make them unsustainable.

-

The Traditional PPM Middle Ground — These tools bring structure but impose a heavy, linear tax. High upfront costs combine with ongoing manual work to connect plans with financial models, causing the burden to grow predictably with each new project.

-

The Optacube Advantage — This is how you eliminate the tax. Our platform absorbs complexity by automating the connection between strategic data and financial models, keeping your Strategy Tax low and predictable even as enterprise complexity soars.

How Complex Is Your Business?

To assess your Strategy Tax, start by diagnosing your complexity level across four key dimensions. Where does your organization fall on each scale?

-

Portfolio Scale — From a handful of small internal projects (low complexity) to a multi-year, $100M portfolio of strategic initiatives (high complexity).

-

Organizational Interdependence — From projects contained within a single department (low complexity) to global programs requiring collaboration across business units, geographies, and vast supplier ecosystems (high complexity).

-

Technological Novelty — From routine upgrades using established technology (low complexity) to pioneering AI-driven platforms where best practices are still emerging (high complexity).

-

Market Uncertainty — From stable, predictable markets (low complexity) to volatile environments with disruptive technology, shifting customer needs, and intense competition (high complexity).

The higher you score across these dimensions, the more you’re paying in hidden taxes if you’re still using outdated tools.

From Hollow Execution to Value-Driven Execution

Most systems treat the business case as a static document—a hurdle for approval that gets filed away and forgotten. This creates what we call Hollow Execution: managing tasks, timelines, and budgets completely disconnected from the financial justification that secured approval in the first place.

Eliminating the Strategy Tax requires a shift to Value-Driven Execution.

This means making the business case a live, dynamic component of the initiative itself—a single source of truth where every project change instantly reflects in financial forecasts.

This is what Optacube was built to deliver. We anchor every initiative to a living business case, transforming it from a static artifact into the official system of record for value creation.

Stop Paying the Tax

Your business is already paying the Strategy Tax—in late-night reconciliation sessions, in projects that miss their ROI targets, in market opportunities lost to slow decision-making.

The question isn’t whether the tax exists. It’s whether you’ll keep paying it.

By anchoring your strategy in financial rigor, you can transform a hidden liability into a competitive advantage.

Ready to eliminate the Strategy Tax? Contact us for a personalized assessment of your complexity profile and discover how much you could save.