Why successful execution requires both Strategic Alignment and Financial Anchoring, and how most companies are missing at least one

The Question That Reveals Everything

Your leadership team has spent months crafting the perfect strategy. You’ve invested millions in projects designed to capture new markets and drive innovation. Yet one nagging question remains: is any of it actually working?

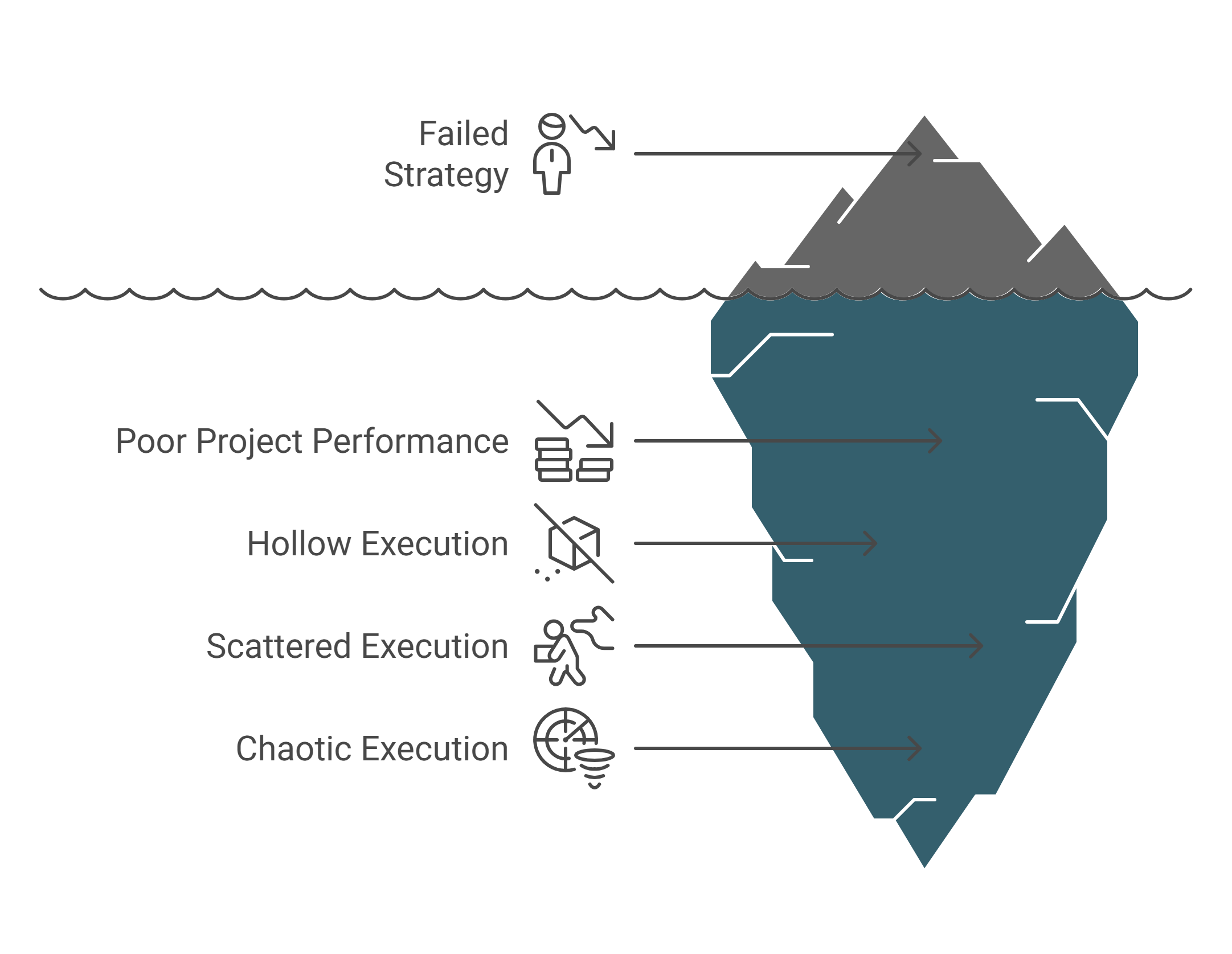

If this sounds familiar, you’re not alone. McKinsey reports that 70% of business transformations fall short of their goals. The gap between strategy debated in the boardroom and execution happening on the ground has become a massive liability. According to the Project Management Institute, for every $1 billion invested in projects, a staggering $122 million is wasted due to poor performance.

The problem isn’t lack of effort or shortage of software. The problem is that most companies are trapped in an execution state that is either hollow, scattered, or chaotic.

You have a strategy. You have projects. But are they truly connected in a way that creates value?

The Two Pillars That Define Execution Success

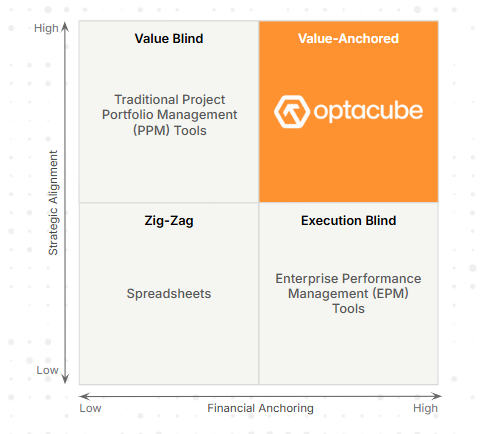

To diagnose the health of your strategy execution, measure it against two critical pillars:

-

Strategic Alignment measures how well your day-to-day projects and resource allocations connect directly to your stated corporate objectives. High alignment means every action has a purpose, and teams focus on moving the right needles. Low alignment means teams are busy, but their activity doesn’t contribute to the company’s most important goals.

-

Financial Anchoring measures how deeply your strategic initiatives are grounded in a live, dynamic, and verifiable financial model. High anchoring means you understand the real-time financial impact of every decision and can accurately forecast value. Low anchoring means your financial justification relies on static, error-prone spreadsheets that become outdated the moment they’re created.

When you plot these two pillars on a map, you can quickly identify where your organization stands — and what you need to fix.

optacube is the only platform that bridges the gap between Strategic Alignment and Financial Anchoring.

We give you strategic visibility without losing granular control

The Four Quadrants: Where Do You Fit?

Most companies find themselves in one of three quadrants of inefficiency. Which best describes your reality?

- Bottom-Left: Zig-Zag Execution

This is the default state for many organizations, running on a patchwork of disconnected spreadsheets. With both low strategic alignment and weak financial anchoring, execution is chaotic.

Teams work hard, but in conflicting directions. Critical decisions rest on untrustworthy data. Research shows that 88% of spreadsheets contain significant errors.

This quadrant isn’t just inefficient; it’s dangerous. - Top-Left: Hollow Execution

This is the world of traditional Project Portfolio Management (PPM) tools. These platforms excel at creating the appearance of strategic alignment.

They produce beautiful roadmaps and dashboards linking projects to objectives. However, this alignment is financially hollow.

Because they lack a dynamic financial core, they track activity, not value. No wonder 44% of projects still fail due to lack of meaningful alignment with business objectives.

You know what teams are doing, but you have no idea if it’s creating any real value. - Bottom-Right: Scattered Value

This is the domain of powerful Enterprise Performance Management (EPM) and FP&A tools. These systems provide high financial rigor at the corporate level, enabling sophisticated budgeting and forecasting for the entire company.

The problem? They’re completely disconnected from the projects and programs being executed on the ground. The value they model is scattered, lacking a direct, traceable link to the specific strategic actions supposed to be driving it. - Top-Right: Value-Driven Execution

This is the ideal state, where strategy and finance are dynamically and permanently linked. Here, every project is perfectly aligned with corporate objectives, and that alignment is enforced with a rigorous, live financial model.

This is where leaders make decisions with confidence, knowing exactly how each choice impacts the company’s bottom line.

Until now, this quadrant has been more theoretical goal than achievable reality.

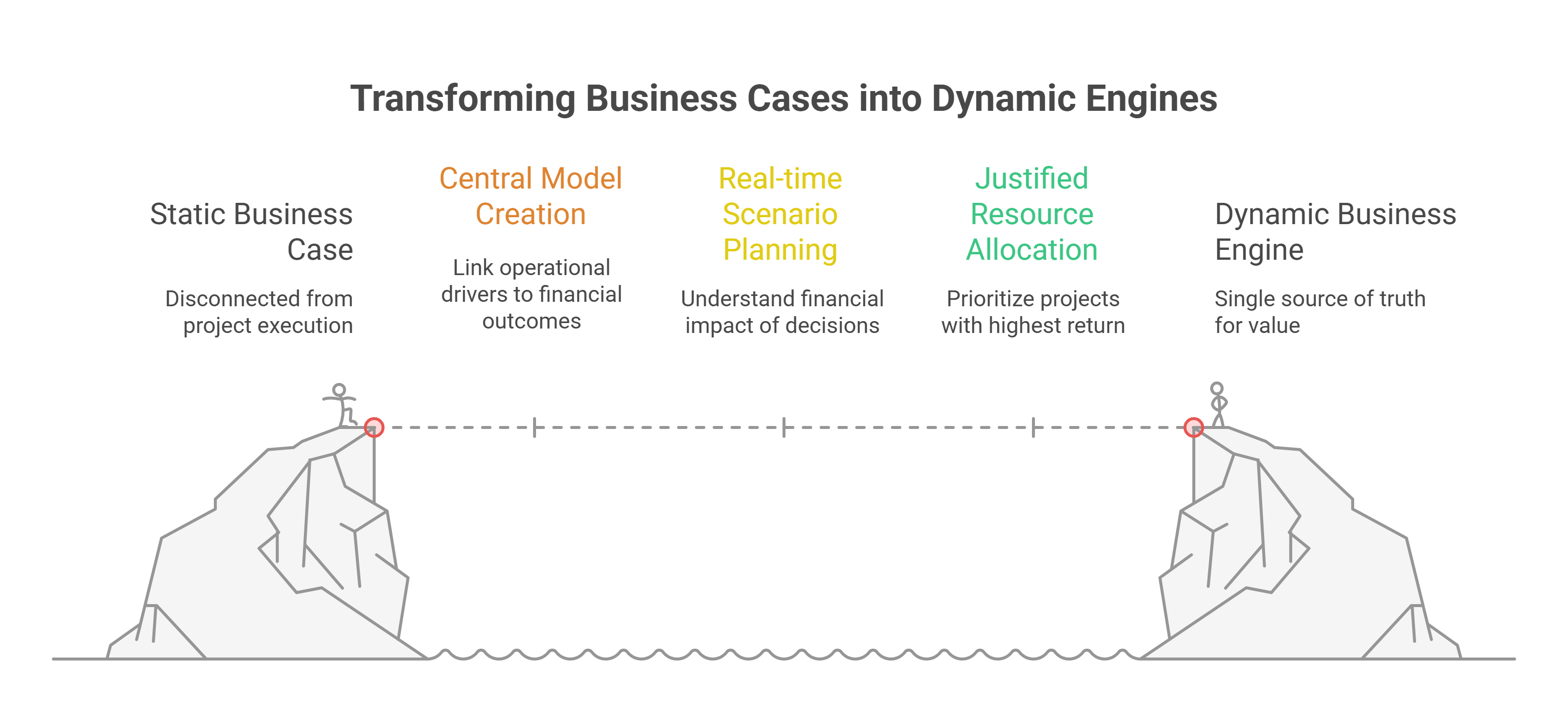

The Missing Link: Activating your Financial Models

The reason these quadrants of inefficiency persist is that the most critical document in any strategic initiative — the financial model — is treated as a disposable artifact. In traditional processes, the financial model is a complex spreadsheet built for a one-time approval gate. Once approved, it’s filed away, instantly becoming a “dead” document, disconnected from the project’s execution reality.

The solution is transforming the financial model from a static document into a live, dynamic engine. This means creating a central model where operational drivers (timelines, resources, scope) are permanently linked to financial outcomes (revenue, cost, ROI).

When a project’s timeline is delayed, the financial forecast updates automatically. When scope is added, the impact on profitability is immediately visible. This creates a single, reliable source of truth for value.

This capability unlocks a new level of strategic agility. Leaders can run “what-if” scenarios in real-time to understand the financial impact of decisions before they’re made. A PMO can justify resource shifts based on which project will deliver the highest return. Finance teams can generate more accurate forecasts because their data is finally grounded in the operational reality of the company’s projects.

The Path to Value-Driven Execution

The journey out of chaos, hollowness, or scattered analysis requires fundamentally changing how your organization perceives value. It demands elevating the financial model from a forgotten administrative task to the central, living heart of your strategy.

This paradigm shift is what platforms like optacube are designed to enable — providing both the “Financial Anchoring” and “Strategic Alignement” that has been missing from every other tool.

What Makes optacube Different

optacube bridges the gap between Strategic Alignment and Financial Anchoring, giving you strategic visibility without losing granular control. The platform operates at three interconnected levels:

- Atom Level: Product — Build products with unit economics precision. Model every revenue and cost at unit-level precision, with financial impacts updating instantly as engineering design decisions are made.

- Execution Level: Project — Execute with live financials. Every project becomes a live financial model where P&L, cash flow, and resource needs update automatically, replacing static reporting with dynamic visibility into true cost and revenue drivers.

- Orbit Level: Strategy — Steer with strategic foresight. Connect daily decisions to long-term enterprise value and instantly simulate how product changes or market forces impact your multi-year strategy.

Core Capabilities for Your Financial Command Center

- Drive Strategy — Connect your long-range plans directly to your live financial model, and see the real-time impact of every decision to ensure they all serve your core strategy.

- Model with Precision — Build, analyze, and manage complex financial models in a fraction of the time with guided, error-proof interfaces and built-in models you can trust.

- Bid to Win — Win more competitive bids by acting with speed and confidence. Model complex quotes and instantly simulate risks, presenting a solid business case before your competition can even debug their spreadsheet errors.

- Track Variance — Bridge the gap between planning and execution by pulling actuals from your systems to measure performance against your original plan, instantly spotting deviations and tracing the audit trail of your variance.

From Disconnected Activities to a Portfolio of Value

The future of execution isn’t just about better planning — it’s about building a resilient, financially-aware culture where every decision is grounded in real-time financial reality.

That journey starts by fixing the broken link at the heart of every project: financial model behind your business case.

Stop treating your business case as a document to file and forget. Start treating it as the living engine that connects your strategy to your bottom line.